EtherMail Price: A Market Overview

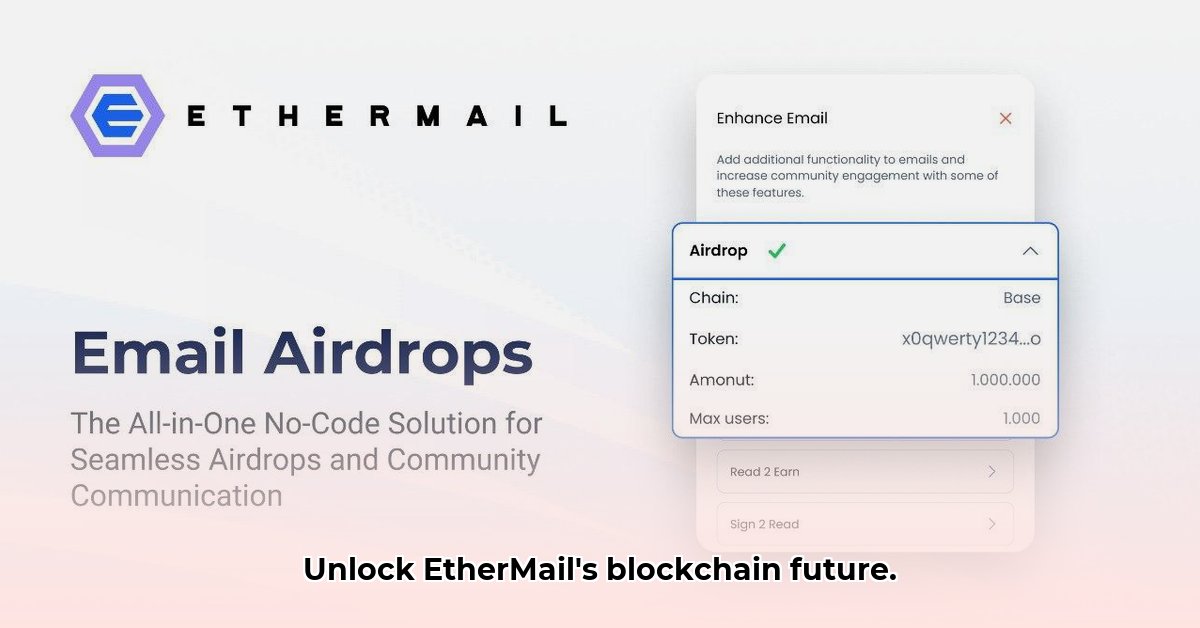

EtherMail (EMT), a blockchain-based email platform, aims to revolutionize email communication through enhanced security and user control. However, its journey in the volatile cryptocurrency market presents a complex picture. Analyzing its current market position requires a nuanced understanding of its technology, adoption rate, and the inherent risks involved in cryptocurrency investments. Is the current low price a temporary setback or a reflection of deeper underlying issues? This analysis delves into these questions.

The Price Discrepancy: A Cause for Concern

A significant initial observation is the disparity in reported EtherMail prices across different cryptocurrency tracking websites. While some platforms show a relatively promising price, others list it near zero. This inconsistency raises serious concerns about data accuracy and the project's overall market traction. Such inconsistencies severely hamper investor confidence and hinder a clear assessment of EMT's true market value. It's crucial to understand the reason behind these discrepancies before making any investment decisions. Does this reflect a lack of trading volume, inaccuracies in reporting, or a more fundamental problem?

EMT Tokenomics: A Deep Dive

EtherMail utilizes its native token, EMT, built on the Ethereum network. The token's value is intrinsically linked to the platform's adoption and utility. The project boasts an AI-powered marketing strategy, promising to drive user growth. However, the effectiveness of this strategy remains unproven, directly influencing the EMT token price. The ambitious AI-driven marketing strategy bears close scrutiny. Will it be a game-changer, or will it fail to deliver the promised user influx?

Technological Foundation: Strengths and Limitations

EtherMail leverages the Proof-of-Stake (PoS) consensus mechanism (a method for verifying transactions in a blockchain), offering a more energy-efficient alternative to Proof-of-Work (PoW) systems. This is a positive attribute. However, challenges remain. Potential centralization of network control raises security concerns and the platform's scalability in handling large user bases remains untested. Moreover, the platform's adherence to global privacy regulations (like GDPR and CCPA) will be essential for its long-term viability and user trust. Can the technology scale sufficiently to handle a large user base without compromising speed or security? This is a critical factor affecting future price performance.

Market Performance and Adoption Challenges

Currently, the EMT token price is low across major exchanges, suggesting limited adoption. The project's success hinges on its ability to attract and retain users. Listing on additional exchanges and demonstrable user growth are crucial for price appreciation. The low price suggests limited market traction, raising questions about the project's long-term prospects. What strategies will EtherMail employ to increase user adoption?

Risk Assessment: Navigating the Uncertainties

The EtherMail investment carries significant risk. The following table summarizes key risk factors and potential mitigation strategies:

| Factor | Risk Level | Potential Mitigation Strategies |

|---|---|---|

| Price Volatility | High | Diversification of investments, thorough due diligence, risk tolerance assessment |

| Low User Adoption | High | Improved marketing, enhanced user experience, strategic partnerships |

| Regulatory Compliance | Medium | Proactive engagement with regulators, transparent data handling practices |

| Technical Scalability | Medium | Continuous development, robust testing, exploration of Layer-2 scaling solutions |

| Dependence on Ethereum | Medium | Monitoring Ethereum network developments, considering alternative blockchain options |

The success of EtherMail, and consequently, the EMT token price, heavily relies on the team's ability to address these risks effectively.

Future Outlook: A Cautious Prediction

The future of EtherMail and its price remains uncertain. While the underlying technology holds promise, market acceptance and sustained growth are far from guaranteed. Continued monitoring of the project's development, user adoption rates, and regulatory landscape is crucial for informed decision-making. The inherent volatility of the cryptocurrency market adds another layer of complexity.

Key Takeaways:

- Price discrepancies across exchanges signal potential data issues or limited market liquidity.

- The success of EtherMail hinges on attracting and retaining users.

- Addressing scalability, security, and regulatory compliance is crucial for long-term viability.

The EtherMail price trajectory will depend heavily on the team's success in overcoming these challenges and achieving meaningful user adoption. Potential investors should exercise caution and conduct thorough research before committing any capital.